Cabarrus property tax bills due; new listing period begins

Published on December 30, 2022

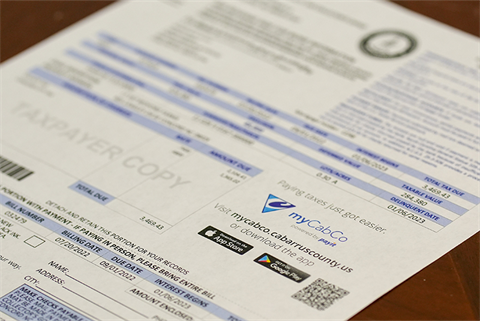

The new year is just days away and County officials are reminding residents that January also brings the grace period deadline for paying 2022 real estate and personal property tax bills.

The month of January is also the window for filing any new tax listings for personal property. This includes changes made to home or business buildings or other structures on your land, or if you own taxable personal property such as vehicles that don’t have an annual registration renewal with the North Carolina Department of Motor Vehicles (like trailers, campers) or recreational vehicles (such as jet skis, boats, etc.).

Tax bill grace period ends on January 5, 2023

Current tax bills went out to property owners listed on tax records as of January 1, 2022. Those taxes were based on the January 2022 value of property, and property tax rates set by County and municipal officials in June.

The original due date of bills was September 1, but taxpayers are given a four-month window to pay before penalties kick in. After January 5, 2023, property owners are subject to interest charges, collections and/or tax foreclosure.

By visiting myCabCo.cabarruscounty.us or downloading the free myCabCo app, users can create a single, secure wallet that stores all payment, profile and transaction information in one place. From there, users can set up alerts and keep track of their receipts. Payment takes just a few clicks. A paperless billing option is also available, along with:

- An easy-to-follow chat-style walkthrough for a simplified payment process

- A shopping cart that helps you save on service fees by paying multiple bills at once

- The ability to make partial payments, which can help users budget over a longer timeframe

- The ability to register and save properties for even easier payment steps next year

To ease the financial burden of paying annual real estate or personal property tax at one time, the County’s tax collections department will work with taxpayers throughout the year on payment plans that pay the bill in full by the delinquent date. The taxpayer is responsible for contacting the collections office to request a payment plan.

Cabarrus County real estate and personal property tax can be paid:

- Via the myCabCo website (myCabCo.cabarruscounty.us) or app with a credit or debit card

- By mail using the envelope and coupon provided with the bill

- In person at the Cabarrus County Tax Collections office at the Government Center, 65 Church St. S, Concord

For questions or online payment help, call the Cabarrus County Tax Collector at 704-920-2119 or email taxinfo@cabarruscounty.us.

Property tax listing period runs from January 1 through 31

The Cabarrus County Tax Administration recently distributed a fact sheet to accompany the listing form.

Access a full listing FAQ here: cabarruscounty.us/Government/Departments/Tax-Administration/Tax-Assessment/Individual-Personal-Property-FAQs.

Contact the following areas with questions to specific concerns:

Several programs offer tax relief to those who qualify. Visit Cabarruscounty.us and search “Real and Personal Property Tax Exclusion” to learn more.