Cabarrus releases app that explores how County taxes are used

Published on August 09, 2024

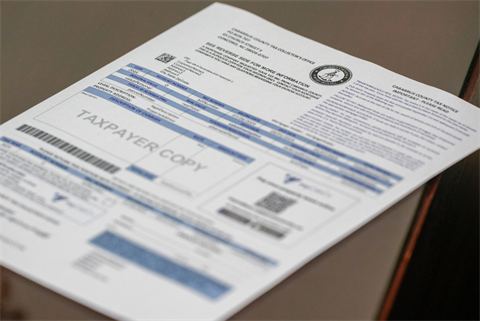

Based on their property value, Cabarrus County taxpayers can now easily determine how and where their tax dollars are used through a new online app.

The app was implemented by the County’s Budget and Information Technology Services (ITS) departments and helps provide a detailed understanding of how an individual’s taxes are used throughout County operations.

Two separate overviews are available: one breaks down the user’s total County tax bill by function and the other breaks down the bill by department. Users can toggle between the two sections in the app.

The figures only account for Cabarrus County property taxes; fire or municipal taxes are not included.

Here’s how the app works:

Visit cabarruscounty.us/TaxBillExplainer or click the “Tax Bill Explainer” tile on the homepage at Cabarruscounty.us. From there, select which version you want to explore (by overall function or by department). Once on the main screen, input the home value (or look it up straight from the app) to arrive at an unofficial “receipt” of how the County uses the funds.

For example, the owner of a $356,350 house (the median single-family assessed home value) would have a $2,052.58 County tax bill.

When broken down by function, the app shows that $695.05 of that total goes toward Education needs, while $425.31 goes to Public Safety. Contributions to the Community Investment Fund ($314.34), Human Services ($264.54) and General Government ($242.76) round out the first five amounts listed in the breakdown.

When broken down by department, the app provides a more detailed look within those main functions.

Throughout the site, information buttons provide access to descriptions of line items. Users can also easily access the online budget book for more detail.

The app pulls information from Fiscal Year 2024-25 (FY25) data. Cabarrus County Commissioners approved the FY25 budget in June, and the new fiscal year started July 1. The budget set the tax rate at 57.6 cents per $100 of assessed value.

Explore the County’s FY25 budget process at https://engage.cabarruscounty.us/budget2025.

Budget Manager Rosh Khatri and Budget Analyst Yesenia Pineda demonstrated the new tax breakdown app for County Commissioners during the August 5 Work Session. Pineda also provides a step-by-step demonstration in a video found through the Tax Bill Explainer tile on the website or directly at https://youtu.be/LPSMyW7JMTw.